Due to fierce competition in the banking sector, where the competitive struggle to win larger market share and attract the largest possible number of customers is constantly being led, and taking into account poorly differentiated offer of banks, adequate customer relationship management is a fundamental tool for achieving better business results

Contemporary financial service industry has become highly dynamic and turbulent, with many changes in form of new regulations, changed consumer behavior, increased usage of information and communication technology and intense competition.

Banks have to invest great effort’s to create added value and one way to do that is to generate and support the development of long-term customer relationships that provide greater value than the value provided by the banking product itself. Building of any added value is hard to achieve nowadays since competitors’ activities, which are often very similar, erode added value of any business.

Even though banking industry has faced significant changes in different business segments during the last two decades, such as: distribution changes (with greater usage of ATMs, PCs, Internet, mobile banking), reduction of transaction costs, increased speed of service substantially, managing of supplier-customer relationships is still one of the crucial issues in banking industry

Besides such changes on the providers’ side, important changes appeared also on the customers’ side. Customers have become more demanding, empowered to perform some activities that were previously handled solely by banks, more knowledgeable, sophisticated, aware of available alternatives, independent, in a position to negotiate with many different service providers and similar.

Under the influence of such changes in customer behaviour and their needs, and with the goal to gain and maintain market competitiveness, banks invest a lot of financial, technological and human resources in customer relationship management (CRM)

Microsoft Cloud for Financial Services offers a comprehensive set of solutions for the financial services market. Bringing together capabilities from Microsoft Dynamics 365, Microsoft 365, and Microsoft Azure, Microsoft Cloud for Financial Services expedites a financial services organization’s ability to roll out solutions.

The Dynamics 365 financial services accelerator focuses on retail and commercial banking to optimize customer experience, improve collaboration within a bank, and gain customer insights.

The accelerator includes sample apps, dashboards, and customer journeys that showcase popular scenarios in the financial services industry.

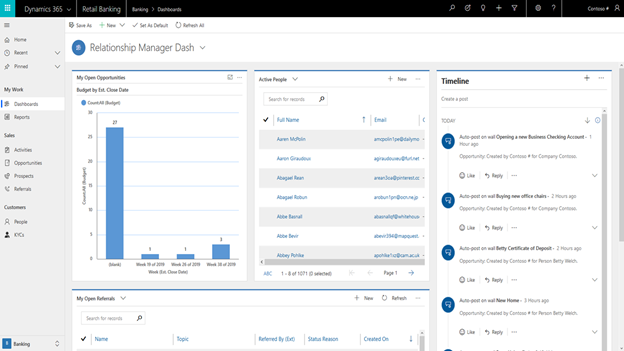

Retail Relationship Manager sits down and logs into their computer. They login to dynamics to get a high-level overview of their day, along with important charts like any Opportunities scheduled to close this week and KYCs with Expiring business licenses this week. The Manager will also be able to see a timeline of their upcoming events and tasks along with all their Open Prospects and Referrals.

This Relationship Manager dashboard used to find out more about the Prospects and Referrals. If the user wants to drill down into any of the information on the right-hand side, the list will change with the selection. With this dashboard they get a holistic view of the different prospects and referrals that the employee owns. If it is a manager, then you can see all the prospects for employees you over see.

The Loan Officer would come to their dashboard to get a well-rounded view of different aspects of their opportunities. Along with an entire list of their open opportunities, they can come here to find out how hot or cold their current opportunities are. There is a chart that shows when financial products they’ve sold are due to mature, and a calendar view of their appointments. The Loan Officer can come to this dashboard in order to know how to organize their day to be most effective.

On the Daily Dash Dashboard, a Relationship Manager would use this to get a view at their Companies and loans they have active. In the top row they will be able to see any Active Companies they are working with on a day to day. To the right of that they would look over and see their Timeline that lists out their various actives they have scheduled. On the bottom row, they can see a chart that lists their Top 5 companies with name and estimated revenue. Next, they’d be able to look and see any companies they’re working with that have active holds on their accounts. Lastly, they can see a list of any loans close to maturing.

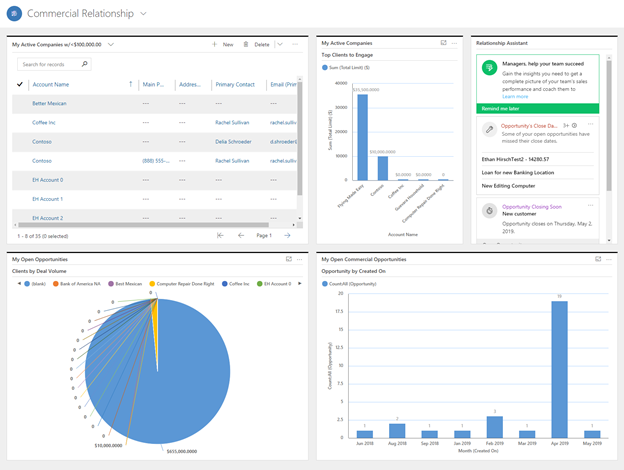

The Commercial Relationship Dashboard would be used by a Relationship Manager to get a look at their accounts and day at a glance. On the top row, they will see a list of their Current Companies with less than $100,000 in Total Limit. Their Top 5 Active Companies they’re assigned to, and their Relationship Assistant describing closing Opportunities and other actions needed. The bottom row shows them Their Open Opportunities by Deal Volume and the Amount of Opportunities created by Month.

Finally, the Application Overview Loan Dashboard developed through Power BI would be used by a Branch Manager to have a holistic view of the Applications across the entire Branch.

Hope this helps!

You must log in to post a comment.